- Roxadustat Positive Pooled Phase 3 Efficacy and Cardiovascular Safety Data Presented Last Friday at American Society of Nephrology 2019 Kidney Week

- Plan to Submit Roxadustat U.S. NDA This Quarter

Conference Call Today at 5:00 p.m. Eastern Time/2:00 p.m. Pacific Time

SAN FRANCISCO, Nov. 11, 2019 (GLOBE NEWSWIRE) -- FibroGen, Inc. (NASDAQ: FGEN) today reported financial results for the third quarter of 2019 and provided an update on the company’s recent developments.

“The FibroGen team achieved many milestones over the past few months, culminating with the positive Phase 3 results for roxadustat reported at the American Society of Nephrology conference last week in Washington, D.C.,” said Jim Schoeneck, Interim Chief Executive Officer, FibroGen. “This set of global studies covered the spectrum of chronic kidney disease anemia and is believed to be the largest and most comprehensive ever reported. We expect the positive cardiovascular safety data, comparing roxadustat to placebo in non-dialysis patients and to epoetin alfa in patients on dialysis, along with the superior efficacy results, can serve as the basis for regulatory approval in the U.S. and other jurisdictions. We plan to submit an NDA in the U.S. by the end of this quarter for both dialysis and non-dialysis patients with our partner AstraZeneca, and an MAA in Europe by the end of first quarter 2020 by our partner Astellas, followed by submissions to other regulatory authorities.

“In addition, roxadustat is now approved for CKD patients with anemia in China and was approved in Japan for anemia in CKD patients on dialysis. Our other clinical programs advanced, as we initiated our roxadustat Phase 2 study to treat anemia in patients receiving chemotherapy and enrolled the first patients in our pamrevlumab Phase 3 programs for both idiopathic pulmonary fibrosis (ZEPHYRUS) and locally advanced pancreatic cancer (LAPIS).

“These major accomplishments demonstrate our commitment to the vision set by FibroGen’s founder and long-time CEO and Chairman, Tom Neff. We mourn his unexpected passing and are grateful for his leadership and rare ability to recognize and advance scientific innovation.”

Recent Developments – Roxadustat

Roxadustat is a novel, oral, first-in-class treatment for chronic kidney disease (CKD) patients with anemia, discovered by FibroGen and developed globally in conjunction with our partners AstraZeneca and Astellas. Groundbreaking science on the body’s oxygen-sensing mechanism and adaptation to hypoxia was awarded the 2019 Nobel Prize in Physiology or Medicine and serves as the foundation for the mechanism of action for roxadustat. Roxadustat increases hemoglobin by mimicking the body’s natural response to low oxygen.

American Society of Nephrology Kidney Week Presentations – November 6-9, 2019

- Clinical results presented from six roxadustat Phase 3 studies comprising over 8,000 anemia patients with chronic kidney disease, as well as pooled results for patients not on dialysis and on dialysis, including an incident dialysis subgroup

- For additional data presented, please see our November 8, 2019 press release

- Please also see our website for FibroGen’s ASN presentations

- Cardiovascular Safety Confirmed: In both non-dialysis dependent and dialysis dependent CKD anemia patients:

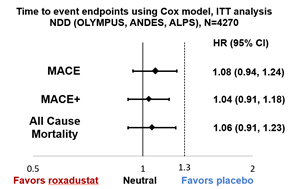

- Non-Dialysis Dependent (NDD) (n=4270):

- Risk of MACE, MACE+, and all-cause mortality in roxadustat patients was comparable to placebo based on a reference non-inferiority margin of 1.3

- NDD results are based on ITT long-term follow-up analysis method agreed with the FDA

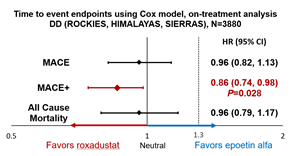

- Dialysis Dependent (DD) (n=3880):

- Risk of MACE and all-cause mortality in roxadustat patients were not increased compared to the active comparator, epoetin alfa

- Roxadustat patients had a 14% lower risk of MACE+ than epoetin alfa patients

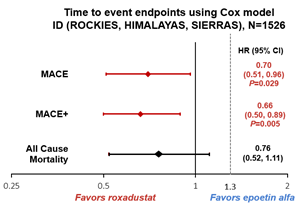

- Incident Dialysis (ID) Subgroup (n=1526): In the clinically important ID subgroup of patients, initiating dialysis within 4 months prior to randomization:

- Roxadustat patients had a 30% lower risk of MACE than epoetin alfa

- Roxadustat patients had a 34% lower risk of MACE+ than epoetin alfa

- Roxadustat patients had a trend towards lower all-cause mortality compared to epoetin alfa

- Endpoint definitions, using centrally adjudicated events:

- Time to first Major Adverse Cardiovascular Events (MACE), a composite endpoint including all-cause mortality, myocardial infarction, and stroke

- Time to first MACE+, referring to MACE plus unstable angina and heart failure requiring hospitalization

- Time to all-cause mortality

- Primary Efficacy Endpoints Met in all Individual Studies and Pooled Analyses

- Met primary efficacy endpoint of mean change in hemoglobin (Hb) from baseline to average Hb weeks 28-52 in each of the six individual studies and in each of the two pooled efficacy analyses

- Statistically superior to placebo in the NDD pool

- Statistically superior to epoetin alfa in the DD pool

- Other Pooled Efficacy Analyses

- Non-Dialysis Dependent

- In the pooled analysis, roxadustat was superior to placebo, with significantly larger Hb increase than placebo regardless of iron-repletion status at baseline

- Roxadustat treatment reduced the need for rescue treatment and red blood cell transfusion (RBC) compared to placebo

- Roxadustat slowed the decline in renal function compared to placebo in patients eGFR >= 15

- Roxadustat reduced LDL cholesterol

- Dialysis Dependent

- The larger Hb increase in patients treated with roxadustat vs. epoetin alfa was particularly notable in patients with inflammation (elevated CRP level)

- Roxadustat treatment reduced the need for RBC transfusion compared to epoetin alfa

- Less IV iron was required in patients receiving roxadustat versus patients receiving epoetin alfa

Other Recent Developments, Recognition and Future Milestones

Roxadustat U.S. and EU Regulatory Timelines

- Expect to submit U.S. NDA for roxadustat for the treatment of anemia in CKD patients both on dialysis and not on dialysis this quarter

- Astellas expected to submit the Marketing Authorization Application (MAA) to the European Medicines Agency (EMA) within the second half of their 2019 fiscal year, ending March 2020

Roxadustat for Anemia in CKD – Approvals and Market Activity

- Expanded approval of roxadustat (China tradename: 爱瑞卓®) in China to include the treatment of anemia in CKD patients who are not dialysis-dependent

- Roxadustat (Japan tradename: Evrenzo®) approved in Japan for the treatment of anemia associated with CKD in dialysis patients

- First prescriptions written for roxadustat for patients in China

- FibroGen booked commercial product revenue for the first time (China)

- Roxadustat received the 2019 Dushu Lake Prize 独墅湖杯 in China for “On-Market Innovative Drug with Highest Clinical Value”

- Results from the two China Phase 3 studies published in the New England Journal of Medicine(NEJM)

Development Programs

- Roxadustat for Anemia in Oncology

- Myelodysplastic Syndromes (MDS)

- Clinical proof-of-concept study accepted for oral presentation at the 2019 American Society of Hematology Annual Meeting

- Randomized placebo-controlled portion of global Phase 3 study ongoing

- Chemotherapy-Induced Anemia (CIA)

- Initiated patient dosing in Phase 2 study

- Pamrevlumab for Idiopathic Pulmonary Fibrosis (IPF)

- Initiated dosing in the pivotal ZEPHYRUS Phase 3 randomized, double-blind, placebo-controlled study

- Pamrevlumab for Locally Advanced Pancreatic Cancer (LAPC)

- Initiated dosing in the pivotal LAPIS Phase 3 randomized, double-blind, placebo-controlled study

- Pamrevlumab for Duchenne Muscular Dystrophy (DMD)

Expect to meet with the FDA this quarter to discuss clinical development plan

Corporate and Financial

- Net loss for the third quarter of 2019 was $49.4 million, or $0.57 net loss per basic and diluted share, compared to a net loss of $42.6 million, or $0.50 net loss per basic and diluted share one year ago

- At September 30, 2019, FibroGen had $666.5 million in cash, restricted time deposits, cash equivalents, investments, and receivables

Conference Call and Webcast Details

FibroGen will host a conference call and webcast today, Monday, November 11, 2019, at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time) to discuss financial results and provide a business update. A live audio webcast of the call may be accessed in the investor section of the company’s website, www.fibrogen.com. To participate in the conference call by telephone, please dial 1 (888) 771-4371 (U.S. and Canada) or 1 (847) 585-4405 (international), reference the FibroGen third quarter 2019 financial results conference call, and use confirmation number 49132826. A replay of the webcast will be available shortly after the call for a period of four weeks. To access the replay, please dial 1 (888) 843-7419 (domestic) or 1 (630) 652-3042 (international), and use passcode 4132826.

About Roxadustat

Roxadustat (FG-4592) is a first-in-class, orally administered small molecule HIF-PH inhibitor that promotes erythropoiesis through increasing endogenous production of erythropoietin, improving iron regulation, and overcoming the negative impact of inflammation on hemoglobin syntheses and red blood cell production by downregulating hepcidin. Administration of roxadustat has been shown to induce coordinated erythropoiesis, increasing red blood cell count while maintaining plasma erythropoietin levels within or near normal physiologic range in multiple subpopulations of chronic kidney disease (CKD) patients, including in the presence of inflammation and without a need for supplemental intravenous iron. Roxadustat is currently approved in China for the treatment of anemia in CKD patients on dialysis and patients not on dialysis and approved in Japan for the treatment of anemia in CKD patients on dialysis. Roxadustat is in Phase 3 clinical development in the U.S. and Europe and in Phase 2/3 development in China for anemia associated with myelodysplastic syndromes (MDS), and in a Phase 2 U.S. trial for treatment of chemotherapy-induced anemia.

Astellas and FibroGen are collaborating on the development and commercialization of roxadustat for the treatment of anemia in territories including Japan, Europe, the Commonwealth of Independent States, the Middle East, and South Africa. AstraZeneca and FibroGen are collaborating on the development and commercialization of roxadustat for the treatment of anemia in the U.S., China, and other markets in the Americas and in Australia/New Zealand as well as Southeast Asia.

About Pamrevlumab

Pamrevlumab is a first-in-class antibody developed by FibroGen to inhibit the activity of connective tissue growth factor (CTGF), a common factor in fibrotic and proliferative disorders characterized by persistent and excessive scarring that can lead to organ dysfunction and failure. Pamrevlumab is in Phase 3 clinical development for the treatment of idiopathic pulmonary fibrosis (IPF) and for the treatment of locally advanced unresectable pancreatic cancer (LAPC), and in Phase 2 clinical development for the treatment of Duchenne muscular dystrophy (DMD). The U.S. Food and Drug Administration has granted Orphan Drug Designation to pamrevlumab for the treatment of patients with IPF, LAPC, and DMD. Pamrevlumab has also received Fast Track designation from the U.S. Food and Drug Administration for the treatment of patients with IPF and LAPC. Across all clinical studies, pamrevlumab has consistently demonstrated a good safety and tolerability profile to date. For information about pamrevlumab studies currently recruiting patients, please visit www.clinicaltrials.gov.

About FibroGen

FibroGen, Inc., headquartered in San Francisco, California, with subsidiary offices in Beijing and Shanghai, People’s Republic of China, is a leading biopharmaceutical company discovering and developing a pipeline of first-in-class therapeutics. The company applies its pioneering expertise in hypoxia-inducible factor (HIF) and connective tissue growth factor (CTGF) biology, and clinical development to advance innovative medicines for the treatment of anemia, fibrotic disease, and cancer. Roxadustat, the company’s most advanced product, is an oral small molecule inhibitor of HIF prolyl hydroxylase (HIF-PH) activity, completing worldwide Phase 3 clinical development for the treatment of anemia in chronic kidney disease (CKD), is approved by the National Medical Products Administration (NMPA) in China for CKD patients on dialysis and not on dialysis and by the Ministry of Health, Labour and Welfare (MHLW) in Japan for CKD patients on dialysis. Roxadustat is in Phase 3 clinical development in the U.S. and Europe and in Phase 2/3 development in China for anemia associated with myelodysplastic syndromes (MDS), and in a Phase 2 U.S. trial for treatment of chemotherapy-induced anemia. Pamrevlumab, an anti-CTGF human monoclonal antibody, is in Phase 3 clinical development for the treatment of idiopathic pulmonary fibrosis (IPF) and pancreatic cancer, and is currently in a Phase 2 trial for Duchenne muscular dystrophy (DMD). FibroGen is also developing a biosynthetic cornea in China. For more information, please visit www.fibrogen.com.

Forward-Looking Statements

This release contains forward-looking statements regarding our strategy, future plans and prospects, including statements regarding the development of the company’s product candidates, the potential safety and efficacy profile of our product candidates, our interpretation of the pooled safety analyses and other analyses of the global Phase 3 program for roxadustat, the potential for our Phase 3 program data to form the basis of a regulatory approval, our clinical and regulatory plans, and those of our partners. These forward-looking statements include, but are not limited to, statements about our plans, objectives, representations and contentions and are not historical facts and typically are identified by use of terms such as “may,” “will”, “should,” “on track,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue” and similar words, although some forward-looking statements are expressed differently. Our actual results may differ materially from those indicated in these forward-looking statements due to risks and uncertainties related to the continued progress and timing of our various programs, including the enrollment and results from ongoing and potential future clinical trials, and other matters that are described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and our quarterly report on 10-Q for the fiscal quarter ended September 30, 2019 filed with the Securities and Exchange Commission (SEC), including the risk factors set forth therein. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release, and we undertake no obligation to update any forward-looking statement in this press release, except as required by law.

Condensed Consolidated Balance Sheets

(In thousands)

| |

September 30,

2019 |

|

|

December 31,

2018 (1) |

|

| |

|

|

| |

(Unaudited) |

|

| Assets |

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

196,592 |

|

|

$ |

89,258 |

|

| Short-term investments |

|

432,040 |

|

|

|

532,144 |

|

| Accounts receivable |

|

19,225 |

|

|

|

63,684 |

|

| Inventory |

|

4,908 |

|

|

|

— |

|

| Prepaid expenses and other current assets |

|

133,715 |

|

|

|

4,929 |

|

| Total current assets |

|

786,480 |

|

|

|

690,015 |

|

| |

|

|

|

|

|

|

|

| Restricted time deposits |

|

4,145 |

|

|

|

4,145 |

|

| Long-term investments |

|

10,999 |

|

|

|

55,820 |

|

| Property and equipment, net |

|

43,208 |

|

|

|

127,198 |

|

| Finance lease right-of-use assets |

|

42,064 |

|

|

|

— |

|

| Other assets |

|

7,068 |

|

|

|

3,420 |

|

| Total assets |

$ |

893,964 |

|

|

$ |

880,598 |

|

| |

|

|

|

|

|

|

|

| Liabilities, stockholders’ equity and non-controlling interests |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

| Accounts payable |

$ |

4,055 |

|

|

$ |

9,139 |

|

| Accrued and other liabilities |

|

70,825 |

|

|

|

66,123 |

|

| Deferred revenue |

|

257 |

|

|

|

13,771 |

|

| Finance lease liabilities, current |

|

12,149 |

|

|

|

— |

|

| Total current liabilities |

|

87,286 |

|

|

|

89,033 |

|

| |

|

|

|

|

|

|

|

| Long-term portion of lease obligations |

|

1,242 |

|

|

|

97,157 |

|

| Product development obligations |

|

16,256 |

|

|

|

16,798 |

|

| Deferred rent |

|

— |

|

|

|

3,038 |

|

| Deferred revenue, net of current |

|

98,708 |

|

|

|

136,109 |

|

| Finance lease liabilities, non-current |

|

40,713 |

|

|

|

— |

|

| Other long-term liabilities |

|

36,041 |

|

|

|

9,993 |

|

| Total liabilities |

|

280,246 |

|

|

|

352,128 |

|

| |

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

594,447 |

|

|

|

509,199 |

|

| Non-controlling interests |

|

19,271 |

|

|

|

19,271 |

|

| Total equity |

|

613,718 |

|

|

|

528,470 |

|

| Total liabilities, stockholders’ equity and non-controlling interests |

$ |

893,964 |

|

|

$ |

880,598 |

|

(1) The condensed consolidated balance sheet amounts at December 31, 2018 are derived from audited financial statements.

Condensed Consolidated Statements of Operations

(In thousands, except per share data)

| |

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

| |

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| |

|

|

| |

(Unaudited) |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| License revenue |

$ |

11,935 |

|

|

$ |

— |

|

|

$ |

162,517 |

|

|

$ |

14,323 |

|

| Development and other revenue |

|

20,660 |

|

|

|

29,027 |

|

|

|

85,507 |

|

|

|

90,580 |

|

| Product revenue |

|

579 |

|

|

|

— |

|

|

|

579 |

|

|

|

— |

|

| Total revenue |

|

33,174 |

|

|

|

29,027 |

|

|

|

248,603 |

|

|

|

104,903 |

|

| Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of goods sold |

|

242 |

|

|

|

— |

|

|

|

242 |

|

|

|

— |

|

| Research and development |

|

49,963 |

|

|

|

56,443 |

|

|

|

152,467 |

|

|

|

165,555 |

|

| Selling, general and administrative |

|

35,823 |

|

|

|

15,356 |

|

|

|

84,772 |

|

|

|

45,961 |

|

| Total operating costs and expenses |

|

86,028 |

|

|

|

71,799 |

|

|

|

237,481 |

|

|

|

211,516 |

|

| Income (loss) from operations |

|

(52,854 |

) |

|

|

(42,772 |

) |

|

|

11,122 |

|

|

|

(106,613 |

) |

| Interest and other, net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

(702 |

) |

|

|

(2,739 |

) |

|

|

(2,209 |

) |

|

|

(8,257 |

) |

| Interest income and other, net |

|

4,193 |

|

|

|

3,079 |

|

|

|

12,496 |

|

|

|

7,796 |

|

| Total interest and other, net |

|

3,491 |

|

|

|

340 |

|

|

|

10,287 |

|

|

|

(461 |

) |

| Income (loss) before income taxes |

|

(49,363 |

) |

|

|

(42,432 |

) |

|

|

21,409 |

|

|

|

(107,074 |

) |

| Provision for income taxes |

|

76 |

|

|

|

124 |

|

|

|

256 |

|

|

|

299 |

|

| Net income (loss) |

$ |

(49,439 |

) |

|

$ |

(42,556 |

) |

|

$ |

21,153 |

|

|

$ |

(107,373 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

(0.57 |

) |

|

$ |

(0.50 |

) |

|

$ |

0.24 |

|

|

$ |

(1.28 |

) |

| Diluted |

$ |

(0.57 |

) |

|

$ |

(0.50 |

) |

|

$ |

0.23 |

|

|

$ |

(1.28 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares used to calculate net income (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

87,007 |

|

|

|

84,508 |

|

|

|

86,390 |

|

|

|

83,713 |

|

| Diluted |

|

87,007 |

|

|

|

84,508 |

|

|

|

91,995 |

|

|

|

83,713 |

|

Contact

FibroGen, Inc.

Michael Tung, M.D.

Investor Relations

1.415.978.1433

ir@fibrogen.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/25e7c4f5-b12d-45b0-b7c5-041e37b297f5

https://www.globenewswire.com/NewsRoom/AttachmentNg/1a04ad11-46fe-49c2-b59e-1c4249f63c0e

https://www.globenewswire.com/NewsRoom/AttachmentNg/6c145f15-9dc7-4c24-9aa2-55ae1ca538a0

Source: FibroGen, Inc

|